A legitimate concern when using a Buy and Hold investment strategy is managing market volatility. How do investors use complementary investment strategies and tactics to reduce risk in bear-markets and short-term fluctuations.

All that and more in Episode 56 on the Wilson Wealth Management YouTube channel.

“What exactly is a ‘bear’ market? How does it differ from a ‘bull’ market?”

A bear market is a prolonged period of falling prices. Usually, 20% from its previous high.

A bull market is a prolonged period of rising prices. Usually, rising at least 20% from its previous low.

“What is an average time period for bull and bear markets?”

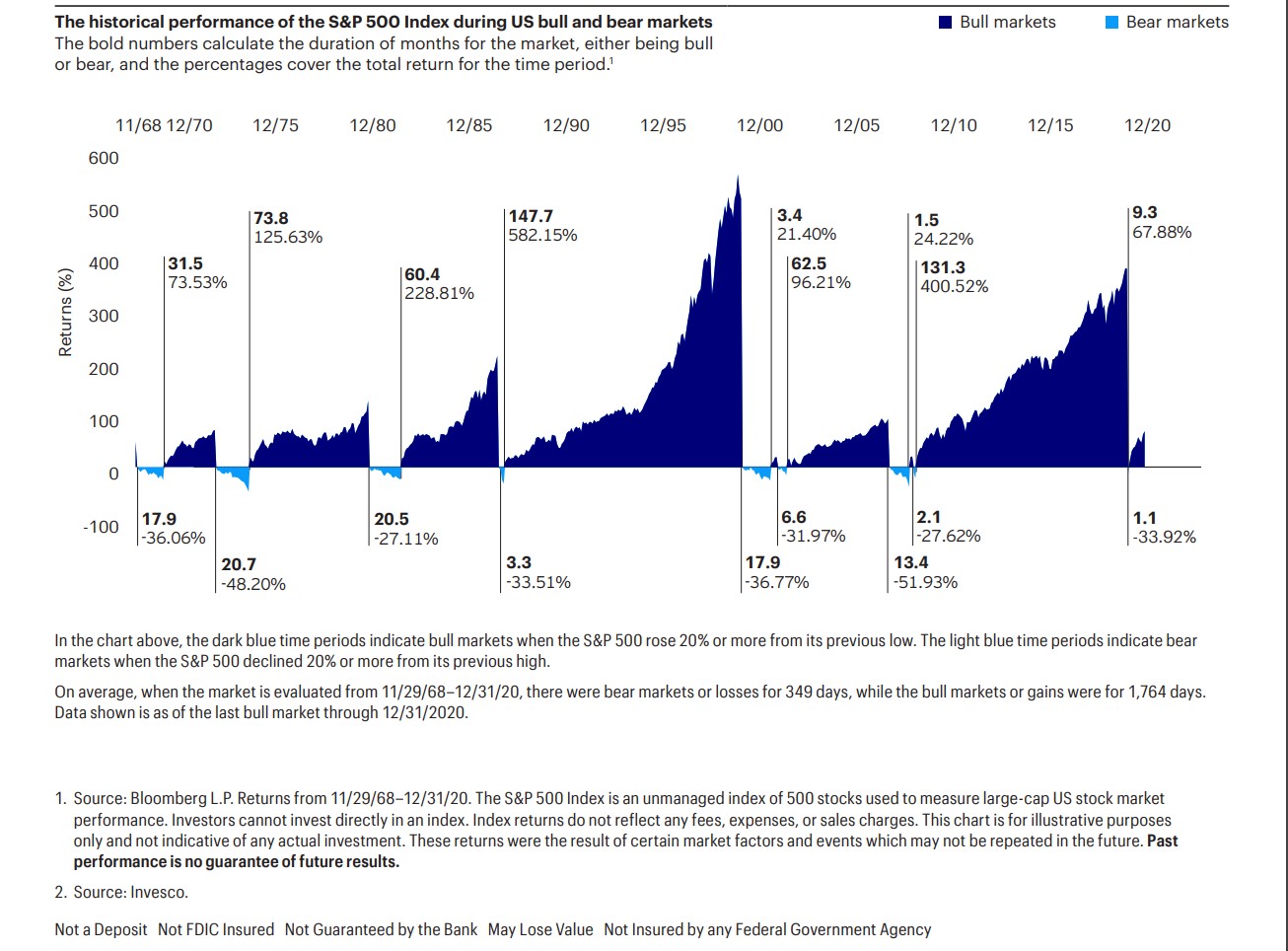

Per Invesco, from 1968 to the end of 2020, the average bull market has averaged 1764 days in length (4.8 years). Once a bull gets underway, it tends to stay for an extended period.

During that same period, there have only been about 7 truly, sustained bear markets that were over 90 days in length. The average length of a bear market has been 349 days. Much shorter in duration than the bull runs.

However, one must factor in the recovery time as well. If you purchased at $100 and it fell to $70, you want to assess how low it took to get back to $100. Not just when the bear market ended and prices began to increase.

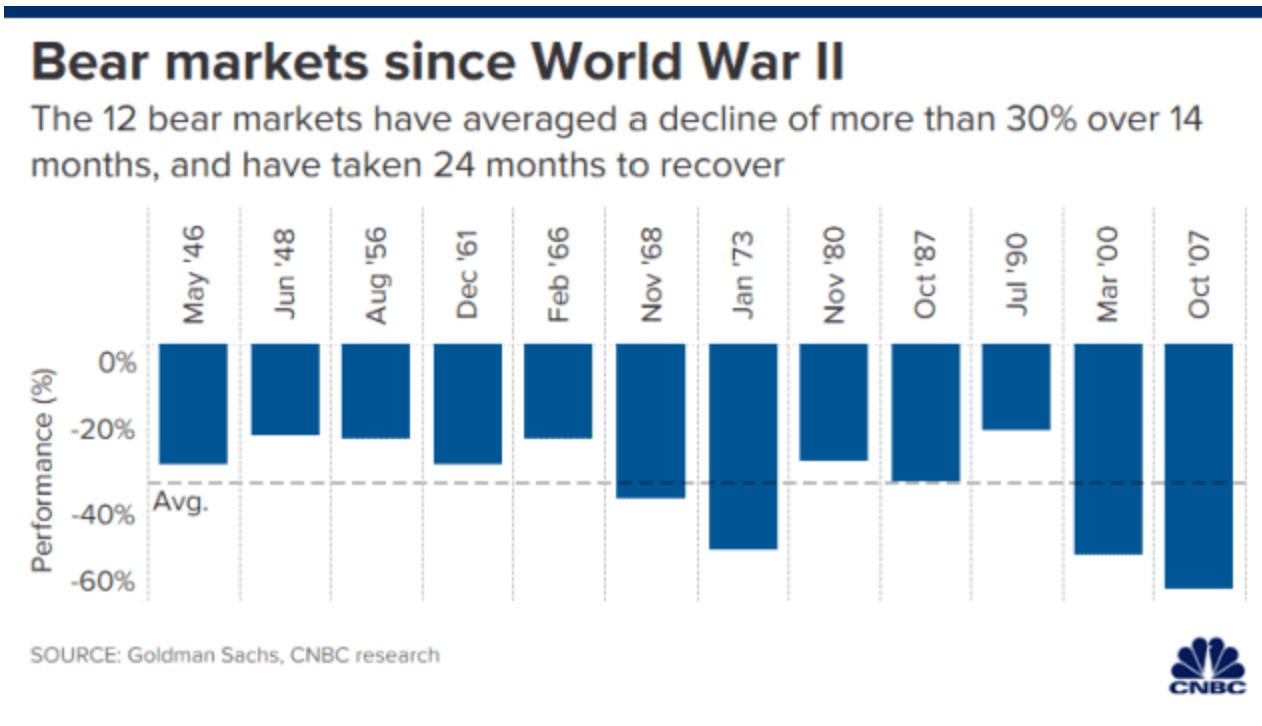

Per Goldman Sachs, it has taken the S&P 500 about 24 months to fully recover once it emerges from the bear market.

“How do my financial goals help me cope with market volatility?”

“How do my financial goals help me cope with market volatility?”

When we reviewed financial objectives, we saw that it was useful to break goals down by time and priority. Then match investment patterns to the objectives.

Investing for retirement in 40 years is very different than saving for a house in 3 years. The 40 year time frame allows for increased investment risk (volatility) in exchange for higher expected returns over time. Short term goals cannot withstand being on the wrong side of market corrections. Instead, investors sacrifice potential return in exchange for safety of capital and liquidity. That is the risk-return relationship.

By matching investments to objectives you remove some of the volatility worries on near term priorities.

“Will my target asset allocation help address volatility concerns?”

An investor’s target asset allocation directly reflects one’s Investor Profile. Which includes financial objectives, constraints, time horizon, financial situation, and risk tolerance.

A proper asset allocation will help set up investments and classes to meet your goals.

As we saw above, matching investment risk to a specific objective will assist in managing volatility. If you invest in more stable investments for a 1 year goal, you are at less risk of market disruption than if invested in riskier, more volatile, assets.

If you invest in higher risk assets for a 35 year retirement goal, you will be more prone to market bull and bear fluctuations. But that long time frame allows you to ride out the ups and downs. As you approach retirement, your time horizon moves from long to medium and then short term. As time lessens, you should slowly shift your assets into lower risk products.

“Portfolio diversification manages investment risk. What about with overall volatility?”

Another aspect of the target asset allocation is diversification. Combining assets with low or negative correlations to manage portfolio risk.

For example, Portfolio Visualizer shows the correlation coefficient between the S&P 500 and US 1-3 Year Treasury Bonds at -0.40 (based on monthly returns from time 01/01/2008 – 06/30/2021).

If you recall our asset correlation discussion, assets with negative correlations tend to move in opposite directions. If the S&P 500 increases, we would expect decreases in the US shorter-term bond market. If the S&P 500 falls or enters a bear market, we would now experience gains on the bond portfolio.

How you diversify your target asset allocation helps cope with market volatility in any one asset class.

“Is combining Dollar Cost Averaging (DCA) with Buy and Hold useful?”

Yes.

DCA involves investing a fixed dollar amount periodically. Perhaps $1000 per month into an S&P 500 index fund.

At $10 per unit, you can purchase 100 units. If the market rises (upside volatility) to $20, you will only be able to buy 50 units. If the market corrects or enters a bear market and prices fall to $5, your $1000 now gets you 200 units.

History shows that over longer time periods, assets appreciate in value. By combining DCA with Buy and Hold you are actually purchasing additional units at a price discount. For younger investors with long time horizons, corrections may be seen as Black Friday Sales events. Why pay $20 when you can pay $5 for the same asset?

“Why is cost minimization so important? Especially in bear markets.”

Costs are important whether the markets are up or down. Cost minimization is key to investing success.

From a money out of your pocket aspect. As well, in lost compound returns over time.

So why is it “especially” important in bear markets?

Probably more of a psychological and behavioural finance issue.

You own an US equity fund. When it returns 18%, you may not be too concerned paying 1.5% in Management Expense Ratio (MER). But what if the fund returns 1.5% or -2.0%? That MER has wiped out your return or almost doubled your loss for the year. Same MER. But in a flat or bear market, investors “feel” the costs to a higher degree.

And no, you do not see fund managers refunding fees to investors in bad times.

To read about this topic, please refer to “Buy & Hold: Market Volatility”.