by WWM | May 29, 2019 | Lump Sum versus Dollar Cost Averaging

Disciplined and consistent investing are similar, but not quite the same thing.

We have already reviewed how dollar cost averaging (DCA) promotes consistency.

Today, we will consider discipline.

What is Disciplined Investing?

For me, discipline means following a well-planned written investment strategy, with minimal emotion.

Unfortunately, many investors are not disciplined. Some do not understand how to build a structured portfolio. They lack the investment expertise and experience to create a proper long-term strategy.

Others do have some experience, but circumstances – personal, general economic, market – cause them to deviate from the planned path.

Emotion often plays a large role in negating self-control and investing discipline.

Individuals get caught up in the euphoria of bull markets. This leads to purchasing at market peaks or getting trapped in investment bubbles. Or afraid of falling prices, they sell into bear markets or entirely avoid investing when prices are falling. Unable to time market bottoms, they then wait too long to invest and miss out on nice gains.

Fortunately, DCA helps achieve the discipline lacking naturally in the majority of investors.

A Quick DCA Recap

DCA involves a longer term, consistent approach, to slowly build a portfolio. Each week/month/quarter/etc., you invest a fixed dollar amount into “solid” investments.

Depending on your investment knowledge, “solid” can mean a variety of things. For those starting out, or who lack the time or desire to develop expertise, I suggest low-cost, well-diversified, mutual funds or exchange traded funds (ETFs) as excellent choices.

The less diversified the investment, the more you must analyze to ensure that it does stay a “solid” investment over time. What might be a good asset today, may or may not be 5 or 10 years out. You do not want to stick with DCA on an investment if it no longer is expected to provide good performance.

That is why passively managed (and low cost) index mutual or ETFs can be useful. As good, new companies are added to an index, the lesser performing (or other criteria) listings are removed. 20 years ago, the top components of the S&P 500 were much different than today.

Because you invest a fixed dollar amount each period, the quantity of the asset acquired fluctuates based on changes in the asset price. If the investment appreciates, you buy proportionately less shares each period. If the investment depreciates, you end up with relatively more each purchase.

Assuming the long-term price trend is positive, you will ride out the short-term hiccups and be buying during down cycles at sale prices.

DCA Promotes Well-Planned Investing

We covered this in our look at consistency. A consistent and steady investing pattern should promote discipline.

You define a constant investment pattern and adhere to it over time. When times are a little tight, you stick with your plan. That is discipline.

If your personal circumstances change significantly and permanently, you can alter your patterns. But do not adjust in haste, especially when thinking about reducing your contributions. Stay disciplined.

Unless financial difficulties are extremely severe, I suggest you try and not shift your investment contributions down. Whether that is with less money or fewer periods. Instead, try and cut other discretionary expenses (e.g., Starbucks) and maintain your investing pattern.

And as you experience permanent increases in income, always try to bump your investing flow. If you get a temporary increase, such as a bonus, invest the windfall without increasing your periodic contributions.

The more (and earlier) that you invest, the greater the long-term compound returns. As you can see, the earlier you invest, the less total money you need to invest. So endure a little financial pain now. It will pay off significantly over time.

DCA Minimizes Emotional Investing

A disciplined investing style should eliminate emotions from the equation.

Should, but in reality for most investors, probably not 100% of the time.

Emotions are emotions, after all. Very hard to control.

To the extent you can eliminate emotions from clouding your investment decisions, the better the probability of long-term financial success.

If you identify and invest in solid assets, you will have less emotional issues during price fluctuations. You expect that the long-term price trend will increase, so you believe that any down turns will be temporary.

And while individual assets, such as Enron or Nortel, may fall forever and ultimately disappear, a well-diversified portfolio should protect you from the nonsystematic risk associated with any one asset.

That should help you sleep at night.

For those made of sterner mettle, you might actually be happy during market downturns when following DCA.

In believing that the long-term price trend is positive, you see temporary price dips as buying assets at a sales price.

For example, you invest $500 monthly into a no-load index mutual fund. In January, with a net asset value (NAV) of $20, you are able to acquire 25 units. In February, the NAV increases to $25 and your $500 will only get you 20 units. But in March, a natural disaster in Japan causes your fund to drop unexpectedly to $16.67. Assuming this is just a temporary blip, you are now able to purchase 30 units at this special sale price.

Not too bad if you are taking a long-term investment perspective with a diversified portfolio.

In short, DCA promotes investment discipline.

One that attempts to ensure a consistent investment pattern. That also assists in minimizing emotional interference during periods of market fluctuations.

by WWM | May 22, 2019 | Lump Sum versus Dollar Cost Averaging

We have seen that Dollar Cost Averaging (DCA) can be a useful tool, especially for smaller investors.

Today we will look at a second advantage. How DCA promotes a consistent investment approach.

Something that greatly assists in achieving long-term investment success.

And something that the majority of investors lack in their investment activities.

Lump Sum Investing Options

With lump sum investing, you can do three things.

One, you have cash on hand, find a suitable asset, and then invest. The preferred method, but most investors do not have cash reserves sitting around.

Two, you slowly accumulate cash over time. When you have a critical mass saved you decide to invest. You look around for recommendations from analysts, media talking heads, or your brother-in-law. Maybe you find something good, maybe not. Maybe it fits into your overall portfolio, maybe not. But you have waited long enough, so you buy something.

Three, you identify an asset to acquire and begin to accumulate funds with which to buy it. Maybe it takes 6 months to save enough before you can make the purchase.

But much can change in 6 months. Perhaps the investment’s potential has fallen. Perhaps comparable investment opportunities have improved in value. What looked like the best investment option 6 (9, 12, etc.) months ago when you did your research, might not be the optimal asset when it comes time to actually invest.

At the time you wish to invest, you always need to do your analysis again. Do not rely on stale research when determining if the asset should be in your portfolio today.

Some investors possess the discipline to accumulate cash over time for investing. But often cash is tight or other priorities arise and the capital never materializes. Another common problem, especially when the snow comes and Mexico beckons.

DCA is More Consistent

With DCA, you consistently invest a fixed amount at pre-determined periods. The amounts and intervals may change over time, but DCA promotes consistent investing patterns.

The idea is that as you continually set aside a relatively small amount of money each period, you will get used to its absence. The money allocated to your investment account is like your monthly telephone bill or utilities statement. The costs automatically come out of most people’s bank accounts each month and they live on what remains.

If you do the same with your investing, soon you will not feel the pain of the monthly contributions. And, when you see the results, it will positively reinforce your decision.

DCA Builds Solid, Diversified Portfolios

I like DCA because you identify solid investments and slowly build up solid portfolio positions.

Of course, like my previous comment, a lot can change over time. What was solid today may not be in 6 months. Prudence and ongoing due diligence must be used in any investing methodology.

That is why DCA is well suited for continuous investments in ready-made diversified assets. Assets that include a variety of individual investments and whose performance attempts to reflect market returns as a whole. Investments such as no-load index mutual funds or exchange traded funds (ETFs).

DCA is Cost-Effective with Diversified Assets

I prefer DCA for fund purchases as opposed to single asset acquisitions.

Let us say you want to build an equity portfolio with 30 stocks of equal weight. A reasonable number for diversification purposes if chosen wisely.

Further, you intend to invest $300 per month in these stocks.

You could allocate $10 to invest in each stock every month as a fair breakdown. But the commissions alone, even from the cheapest online broker, would bankrupt you.

Or you could spend the $300 each month on a different stock, rotating through the desired portfolio every 30 months. A better system. However, if you wish to acquire even a single share of Google ($1200 per share) or Amazon ($1900), you are either out of luck or must allocate much more than one month’s allotment to it.

Or you could do a million other permutations to build your desired portfolio over time.

Or ….

… you could simply find a no-load fund or ETF that holds relatively high concentrations of the desired shares, or similar asset classes, and invest in that one fund.

Each month your $300 will get you a pro rata share of the fund’s holdings. It is easy, cost-efficient, and should come close to meeting your investment objectives.

If you still want to ultimately invest in 30 individual stocks, not a problem. Just invest in the funds until you have a critical mass, say $300,000, then sell the funds and purchase $10,000 each of the individual companies.

Note that often with open-ended mutual funds, you can typically make subsequent fund purchases at low amounts. For example, perhaps an initial minimum purchase is $5000, with subsequent purchases as low as $100. Be sure to look for no-load funds as the loads will greatly diminish long term growth.

With ETFs, you can purchase whatever amount you want, at any time. However, unless it is a no-transaction fee ETF (brokerage houses are beginning to add ETFs that do not charge commissions, but not all of these are “best of breed” funds), you will pay a brokerage fee on every purchase. The smaller the investment, the worse the impact of the transaction costs.

DCA as a No-Brainer

I shall discuss some pitfalls of DCA in a subsequent post. For now I shall simply say that DCA should not be a blind strategy.

If you are DCA in a passive index mutual fund or ETF that is well-diversified, then less work is required to invest.

I did not say no work, just less. That is because you are investing in a low-cost, well diversified portfolio that seeks to match the market returns. You are more concerned about the overall market, how closely the fund tracks that market, and the cost structure of the fund. You are less concerned with the daily happenings of each individual asset within the fund’s holdings.

If you are DCA in individual shares or non-diversified investments, you need to constantly monitor your investment’s potential. How is each asset performing against its peers, industry, or index? What are its future prospects, potential for lawsuits, etc.?

It is fine to average down your costs during a bear market. In fact, that is an advantage of DCA. You can get more bang for your buck during short-term down slides.

But it is completely another thing to be continuously investing in a bad asset. One whose price is falling for fundamental and permanent reasons, not just due to general volatility.

With individual assets, you need to constantly assess whether you are buying at a sale price or whether you are investing in a soon-to-be bankrupt business.

Never blindly use DCA.

If you do, you may end up throwing good money after bad with some of your investments.

Summary

DCA promotes better investing consistency than a lump sum approach for those without ready cash reserves.

While DCA can work with individual assets, it works best when investing in diversified investments such as mutual funds and ETFs. It also is preferable to use DCA in situations where where transaction costs are low.

The stronger consistency of DCA should improve the odds of achieving one’s investment objectives versus a less structured style. So consistency should be striven for when investing for the long run.

A close relation to consistency in investing is discipline.

We will look at that next time.

by WWM | May 15, 2019 | Lump Sum versus Dollar Cost Averaging

Over a longer time horizon, lump sum investing may outperform dollar cost averaging (DCA). But that is usually relatively long and hard to guarantee given short to medium term market volatility. Results vary depending on the timing of investment purchases. Bit of a crapshoot to say that one way or the other always outperforms.

In 2012, Vanguard conducted a study that found lump sum outperforms DCA about 66.7% of the time after 10 years. Vanguard’s study assumes that you have all your investable capital on day 1. Then you either invest 100% on day 1 or spread your purchases between 6 and 36 months. Lump sum often makes sense in this scenario as over longer periods asset classes historically have shown positive returns. The sooner you invest in higher return assets, the better.

However, there are a few reasons I tend to recommend DCA to investors.

The first is that it is great for small investors.

DCA is Tailor-Made for Small Investors

The majority of investors are what I would consider small in nature. They do not have thousands of dollars just sitting around ready to invest in lump sums should a buying opportunity arise. Except for inheritances, home sales, pension freezes, or lottery wins, most investors have to scrimp and save to maximize their (tax efficient) investment accounts.

So they have two choices.

One, stockpile cash reserves until they reach a critical mass, then buy in a lump sum.

While waiting, always store cash reserves in highly liquid assets that offer a positive return. These include: money market funds; sweep accounts through your broker; short-term Guaranteed Investment Certificates or Term Deposits through your bank. Just watch the costs and ensure there are no penalties for cashing in sooner than the term expires.

Two, purchase investments slowly and consistently over time. Using DCA, or other averaging methods, until reaching the desired quantity.

Had Vanguard done a study where an investor needed to slowly accumulate funds before making that lump sum, rather than having 100% on day 1, their results would be different.

Longer the Delay, the Less Advantage for Lump Sum

The longer the accumulation period needed, the greater the potential variance. For someone without ready investment cash for an initial lump sum purchase, I think DCA may not underperform over time. That is, DCA is the better system.

Steady, Appreciating Market, Go Lump Sum

For example, you wish to invest $20,000 in ABC under either a lump sum or DCA method. Commissions are $10 per transaction. DCA will accumulate shares quarterly during the year. Share price during the year is: January 1, $19.99; April 1, $24.95; July 1, $33.27; October 1, $49.99; December 31, $50.00.

Under lump sum, on January 1 you purchase 1000 shares. The unrealized gain at December 31 is $30,000.

Under DCA with quarterly purchases beginning January 1, you end up with 700 shares and an unrealized gain at December 31 of only $15,000.

A clear win for lump sum investing.

Save Over Time, then Lump Sum, Not as Good

Maybe you do not have $20,000 to invest on January 1. It may take 6, 9, or 12 months to amass that amount. But you wait as you prefer the lump sum approach.

Ignoring rounding and interest income as you save the cash, if you bought at July 1, you would get 600 shares for your $20,000. If you wait 9 or 12 months, you are able to buy 400 shares. At year end, your unrealized gains are $10,000 for the July 1 purchase and $0 for the October 1 or December 31 acquisitions.

Under both these scenarios, DCA outperforms lump sum. The same $20,000 investment nets 700 shares using DCA. However, you only receive 600 shares buying July 1 or 400 shares investing October 1.

Depending on the price change of the asset being acquired and the delay in making the lump sum purchase, DCA may have a much better outcome in performance than with lump sum.

Over Time, Price Growth is Seldom Consistent

And that assumed ABC shares appreciated steadily throughout the year. In reality, especially over multi-year periods, prices rise and fall in the short to medium term. Nor do you tend to see many companies increasing 150% in one year.

Perhaps ABC traded at $19.99 on January 1, 2018. And closed December 31, 2019 at $30.00. A two year gain of 50% on your $20,000 lump sum purchase on day 1. Still quite good.

But let us say that you invest that $20,000 semi-annually over the two years. And the stock traded at: January 1, 2018: $19.99; July 1, 2018: $14.50; January 1, 2019: $17.50; July 1, 2019: $24.00; December 31, 2019: $30.00.

With typical equity volatility, your DCA approach netted 1087 shares with an adjusted cost base of $18.40 per share. A lower cost base than had you paid $19.99 per share using lump sum.

Summary

While empirically a lump sum purchase may often outperform DCA in the long run, I do not take those findings as gospel.

First, the studies indicate that lump sum investing is superior about 66.7% of the time, in the long run. That is not a slam-dunk. Especially if you must wait and save before making that lump sum investment.

Second, while the very long run trend in asset valuations is positive, you may need to wait a very long time. And if you buy in at the wrong moment, you may never fully recover depending on your age. Remember that it took 25 years to fully rebound from the 1929 crash of the Dow Jones Industrial Average.

Third, as we have seen above, the lump sum outperformance assumes an up-front investment. If you need to delay your lump sum purchase due to a lack of capital, the results may differ significantly. The longer the delay, the greater the potential variance.

Despite the empirical data, unless you have adequate cash reserves to invest lump sums initially, I believe most investors should utilize DCA.

We will look at a second reason in support of DCA next time.

How DCA promotes a disciplined and consistent approach to investing.

by WWM | May 8, 2019 | Lump Sum versus Dollar Cost Averaging

Why should you build your investment portfolio over time using dollar cost averaging (DCA)?

Good question. Especially as we saw that lump sum investing may be preferable at times.

I tend to recommend DCA for a few reasons. Investment specific, but also for behavioural purposes.

Today, a look at the pure investing side arguments for DCA.

Market Volatility

In my previous post (linked above), over a long time horizon, lump sum usually outperforms. That is because the core asset classes grow in value over time. It makes sense to buy as early as possible.

However, that asset growth is seldom steady.

Dealing with short to medium term market volatility is an advantage of DCA.

At least in theory. In actuality, a case can still be made for lump sum investing. It all revolves around how the longer the time horizon, the more one can withstand asset volatility.

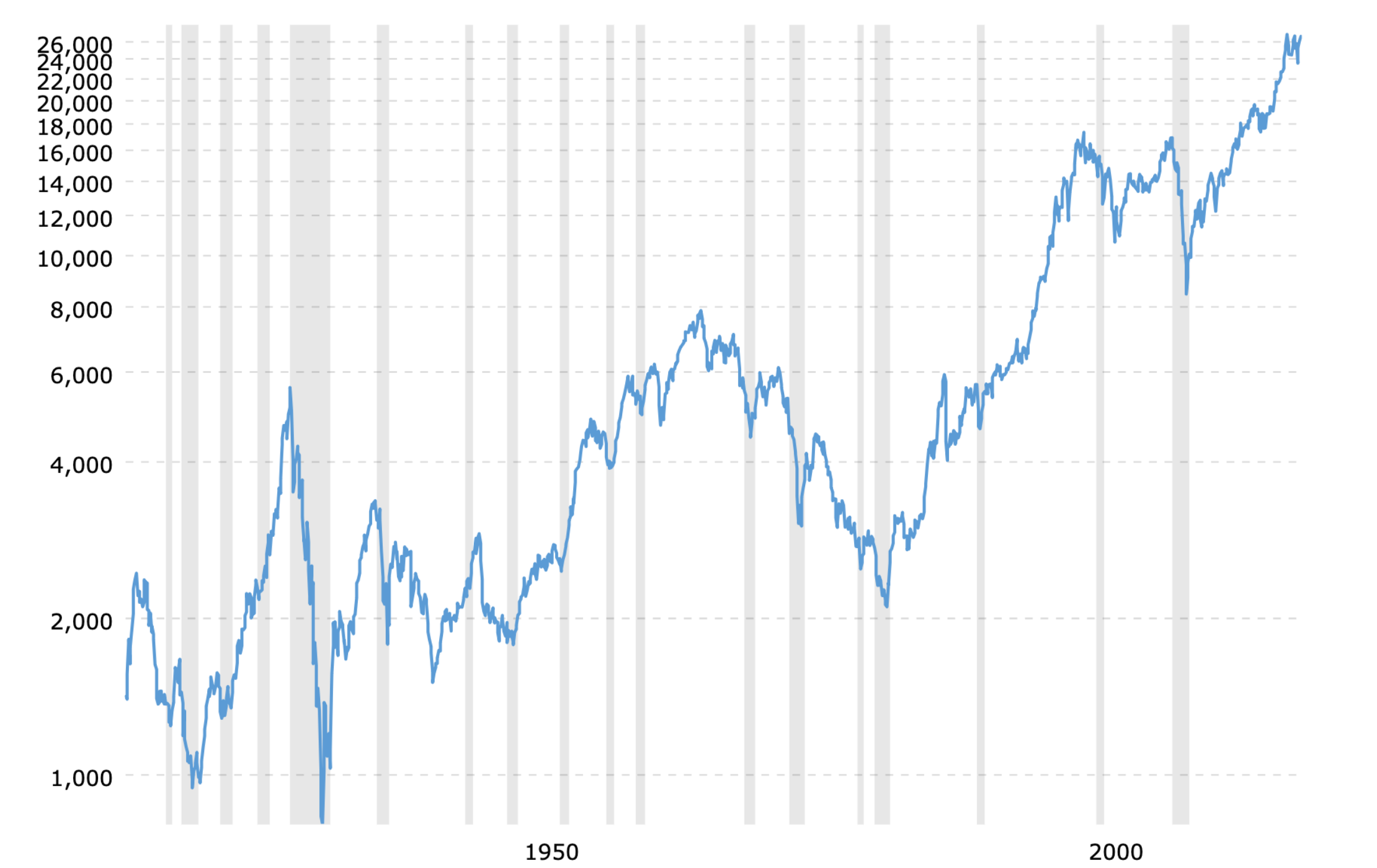

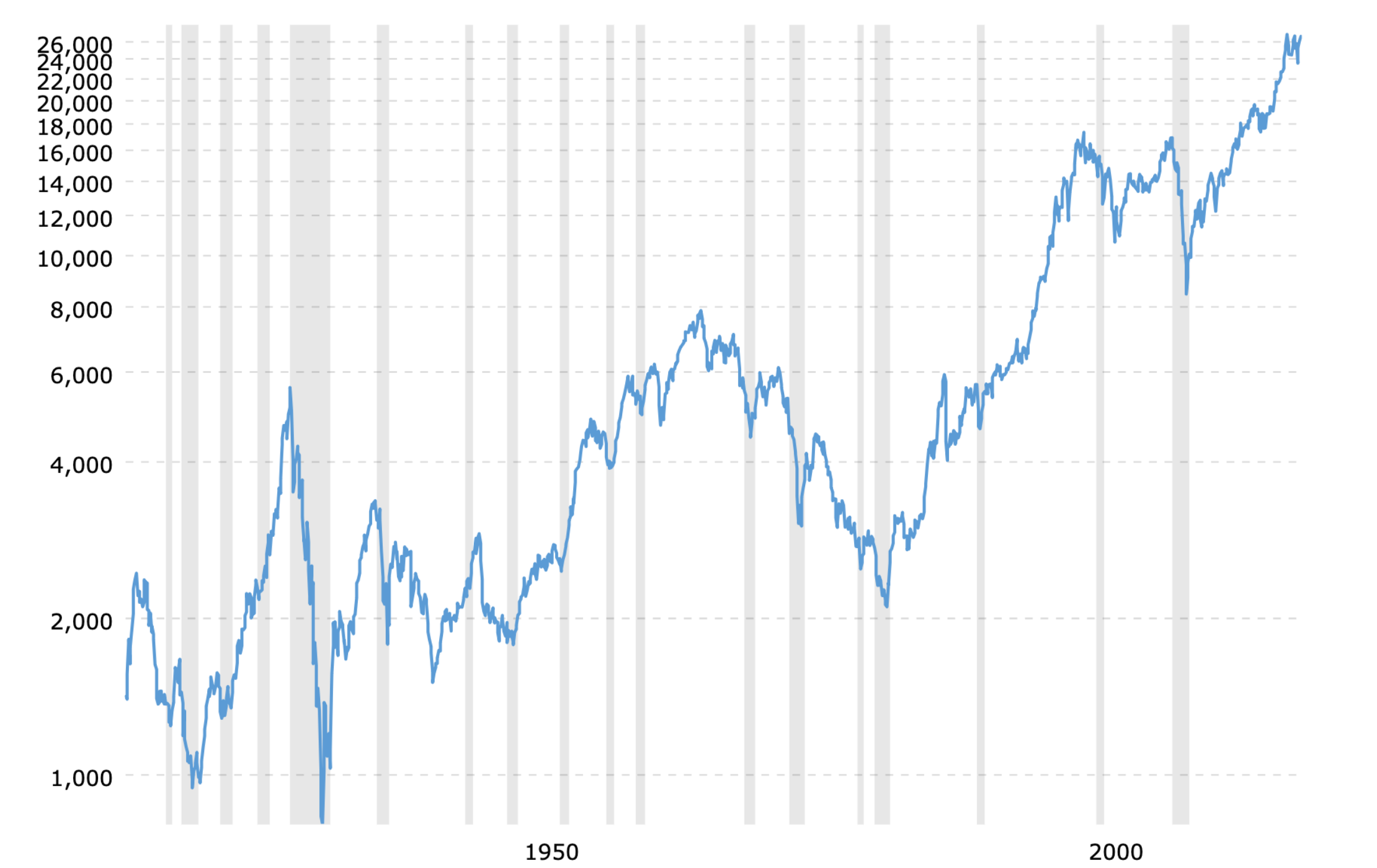

Perhaps you invested 100% of your funds in the U.S. stock markets in the summer of 1929. Between 1929’s peak and the 1932 bottom, the Dow Jones Industrial Average (DJIA) fell 89%. Yet over the long run, you still would have turned a profit with lump sump investing. Even if you had bought at the high point in 1929.

Of course, it would have taken until 1954 to get back to your initial break-even point. But once there, it was smooth long-term growth for a while. Assuming that you were still alive 30 years after the crash, you would have seen positive growth.

Or what if you invested 100% of your assets in early October 1987? On October 19, the DJIA fell 22% in a single day. It took until late 1989 to fully recover.

Or in early October 2008? On October 1, the DJIA traded as high as 11,022. By October 10, it had reached a low of 7774 before closing the day at 8451. A 29.5% drop from high to low in just 10 days. Had you bought just prior to the crash, with a brief exception in April 2010, you would have only returned to your initial investment level at the end of 2010.

Considering the Dow traded around 26,600 as at April 30, 2019, you would have done just fine regardless when you invested. Obviously, not as well as if you timed it better. And likely not as well as having invested in lower risk, less volatile, asset classes. But you would have still shown a positive return over time.

However, you might be in for a lengthy wait to achieve those returns. And depending on the periods involved, you may have achieved superior overall performance through DCA.

DCA May Provide Protection for Shorter Time Horizons

While core asset classes have provided net positive returns over time, there clearly have been hiccups along the way.

This chart from April 1915 to April 2019, courtesy of Macrotrends, provides a nice picture of the DJIA general growth and price fluctuations over time.

As you can see, over the long haul US equities have increased in value. But do you have a 100 year time horizon? Some of the corrections required between 16 and 25 years to recover. If you are fully invested and get caught in a major bear market, that will hurt.

For example, in January 1966 the DJIA traded at 7862. It fell until May 1982, then began to grow again. It was not until October 1995 that the DJIA closed at 7865 and returned to its trading level from 1966. Almost 30 years with zero growth.

To smooth out short and medium term volatility, DCA provides some protection. You can see the potential impact of investing in equal dollar amounts on a monthly, quarterly, or annual basis. When markets are high, you purchase relatively fewer shares. When there is a correction, you purchase relatively more, as you are buying at a “discount.”

And, as we will see much later, through periodic reviews and rebalancing, you may be able to lock in some gains before a crash occurs. That also helps to protect your portfolio from severe market volatility in shorter time periods.

DCA is the Best Approach?

For shorter investment time frames, DCA may allow for outperformance over a lump sum approach. But so much of whether it will outperform depends on the actual time periods involved.

Had you begun a quarterly DCA investing approach in January, 1966, you would have experienced declining equity markets until mid 1982. A significant period of time. You would have been wiser to invest in fixed income or cash from 1966 until 1982, then purchase 100% of your equities at that time. Of course, how many experts predicted the peaks and valleys for you to correctly time the markets?

But by buying continuously as the market declined, you bought at a discount over time. Then when the market began to rise in late 1982, your average cost base was much better than if you had made a lump sum purchase anytime between 1966 and 1976.

In short, over the extreme long run, lump sum may be better. But investors seldom have very long time periods. DCA offers protection against getting caught in a major correction. Usually a safer and smarter way to invest for most people.

On a pure investing basis, DCA may or may not be better than lump sum. Given that most investors do not have infinite time frames, DCA tends to be a preferable method.

Where I do think DCA definitely shines, is in promoting good investing habits for individuals.

by WWM | May 1, 2019 | Lump Sum versus Dollar Cost Averaging

In building your investment portfolio, you can utilize lump sum investing or dollar cost averaging (DCA).

For practical reasons, I think most investors should choose DCA. But there is a case for lump sum investing.

In this post, we will look at potential advantages of lump sum over DCA.

Assets Appreciate Over Time

Investors acquire assets they believe will appreciate in value over time. It makes sense then that the earlier one purchases an asset, the greater the long-term financial gain.

This is the main advantage of lump sum investing over DCA.

For example, your research has led you to conclude that Apple is an excellent long-term investment that will steadily climb in price. If you had $10,000 on hand and ready to allocate to Apple, it would be smart to invest it all immediately.

Believing Apple will steadily grow, you are buying shares today as cheap as they will ever be. Whereas, if you allocate your $10,000 over a longer period (1, 2, or 3 years) to invest, you will be paying a higher price with each purchase date.

But Do Assets Continually Appreciate?

The flaw in that logic is “steadily” grow. Asset values seldom, if ever, grow in a continuously rising straight line. Investments fluctuate in their performance. The more volatile, or risky, an asset, the greater the probable fluctuations in the short or medium term.

If you choose the wrong time to invest, you may experience some unrealized losses in the short term. And it may take an extended period to get back to positive territory.

But do core asset classes really appreciate over the long run?

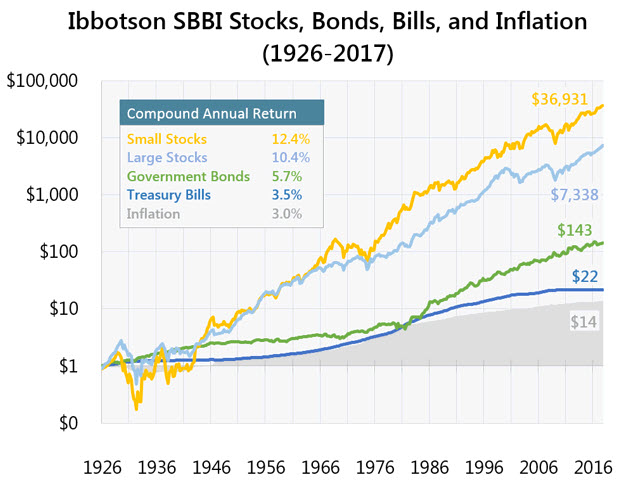

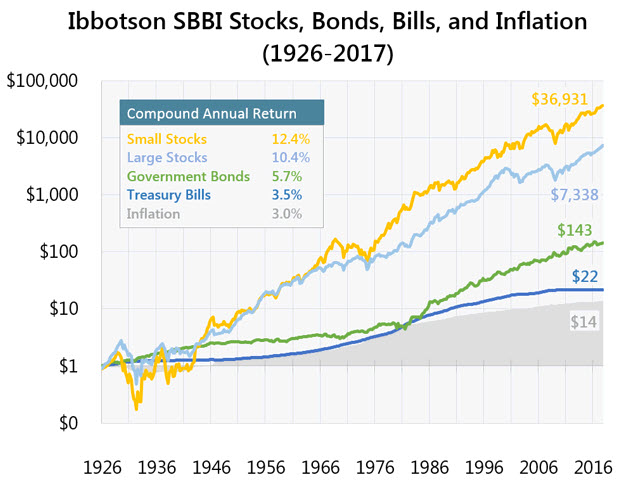

Past performance says yes. If we look at a graph from 1926 to 2017 for inflation, cash, fixed income, and equities, we see positive returns over extended periods. Of course, we also see substantial short term corrections as well.

As an aside, note how the risk-return relationship works in the real world. Cash, the safest asset class, provides the lowest nominal return. When you factor in the real return by subtracting inflation, there is not much growth. But your capital is secure. As you assume increasing risk with your investments, you see higher returns as you move up the risk ladder. And, as risk is a measure of asset volatility, you also can see that the higher risk assets are more price volatile in shorter terms.

Also note the impact over time of compound returns. The annual return over time between T-Bills and Bonds is 2.2%. And the difference between small and large cap stocks is 2.0%. Not that much. Probably what many investors pay their fund companies in management fees. Yet look at the cumulative growth differentials. Incredibly large over time. And why I harp constantly on cost minimization for investors.

Nice to see how the investment theory we have covered, actually plays out in the real world.

Whether this trend continues in the future is another question. But in the past, a lump sum approach would have been profitable over long periods. A better strategy than DCA.

Market Timing May Benefit Under Lump Sum

Or not.

If your market timing skills are excellent, then lump sum investing may be for you.

You would have loaded up your equity portfolio in the 1920s and then divested everything in 1929. Kept your cash under the mattress until 1932, then reinvested in equities. Or similar timing opportunities to sell and wait in January 1973, October 1987, and October 2008. By being very nimble, your growth through proper market timing would have been fantastic.

The problem, of course, is that market timing is extremely difficult. Even for the professionals.

However, if your market timing is wrong, lump sum may still be fine. You just require a lengthy enough time frame to recover. As you can see in the graph, had you bought US equities in 1929, they would have plummeted in the market crash. And yes, it may have taken to 1954 to get back to even. But the markets did recover and continue to grow over time. But you needed a substantial time horizon.

We will look at market volatility in more depth next post.

Less Fees in Lump Sum Investing

Another advantage of lump sum investing relates to transaction costs.

A lump sum investing approach should result in less transaction costs than under DCA.

Many online brokers now offer flat fee trades, regardless of shares bought or sold.

If you invest $10,000 in one lump sum, you may only pay a $10 commission. But if you divide that $10,000 into 10 separate transactions, you will end up paying $100 in total.

While not a lot, it is 1.0% of your initial capital. It should not be ignored, especially when you consider the compound annual return data from our graph above.

Okay, that is the case for lump sum investing.

It is cheaper and the lump sum approach typically outperforms DCA over the long run.

I like low cost. And I love outperformance.

So why do I think DCA is more appropriate for most investors?

We will get to that in “Why Use Dollar Cost Averaging?”