Invest In Your Future

Attaining your financial objectives requires a holistic approach.

One that first considers who you are as a unique individual. Your financial position and prospects. Goals and constraints. Risk tolerance. And much more.

Who you are derives your target asset allocation and specific investments. How we reach your goals over time.

In general, you will take a passive investing approach. With a focus on matching market returns, while minimizing costs.

Investment recommendations will be made, as well as advice on portfolio construction and implementation.

Relevant portfolio benchmarks will be created. To ensure periodic reviews have a comparable basis.

As your personal situation evolves over time, your investor profile will be updated. Resulting in adjustments to asset allocation and investment patterns.

Who are you?

Unique Investor Profile

Your Investor Profile reflects who you are as an individual investor. Where you are today and where you want to go. As such, it will be unique, based on your personal situation.

Financial Situation

What is your financial position today? Income, assets, and obligations? Expectations for growth over time? Anticipated disruptions or new costs?

Your starting point plays a large part in attaining your goals.

Objectives and Constraints

What goals do you have? A comfortable retirement, no doubt. But you will also have other objectives over the short, medium, and long terms. Those need consideration.

What constraints exist that impact goal attainment? Time, fixed expenditures such as debt servicing, and taxes, are common concerns. Those need to be addressed.

RISK TOLERANCE

Are you are risk taker? Or do you prefer safety over return?

Risk tolerance plays a key role in the investment process.

One Size Does Not Fit One

Target Asset Allocation

The Target Asset Allocation reflects your Investor Profile in portfolio form. A proper allocation will aid in meeting your investment objectives.

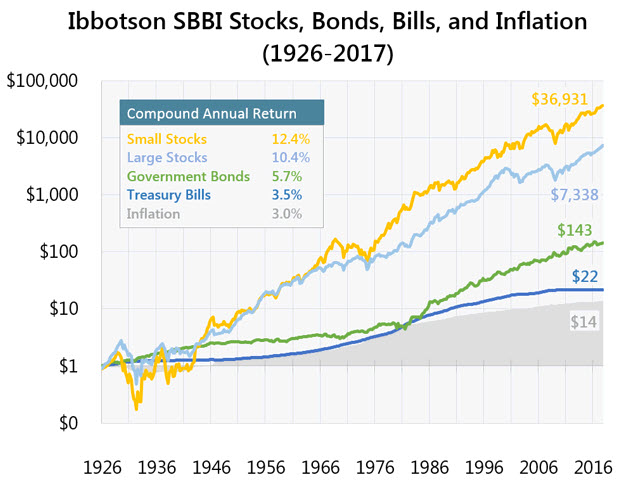

Data indicates that portfolio asset allocation may be more important than the actual investments in creating long-term growth. Proper diversification and asset correlations are critical factors. Between and within asset classes, geographically, over time, and by currency. There are many ways to allocate and all need consideration.

The target allocation will also maintain a structured investing approach in times of volatility.

Reflect your Profile

Investment Portfolio

Your Investment Portfolio reflect your Target Asset Allocation and Investor Profile.

It will be unique to your financial objectives and personal situation. Over time, as your circumstances evolve, your portfolio and its allocations will adjust to reflect new realities.

In general, a passive asset management strategy will be employed. Matching market returns in the chosen asset classes. While minimizing portfolio costs.

On a periodic basis, the portfolio will be reviewed against predetermined benchmarks and desired allocation. Remedial measures, as needed, will be taken to bring back into alignment.

Match Market Returns

Beating market returns through active investing is extremely hard. Studies show that it is very difficult for even professionals to outperform benchmarks in the longer term.

Reasons include: inability to time market or security movements; as successful managers grow larger, they become the market; active managers charge high fees, increasing investor costs; higher transaction and tax costs with increased portfolio turnover.

Investors benefit more through passive investing. The majority of portfolio investments being made in low-cost, well-diversified funds, that closely track performance benchmarks. As wealth accumulates, use of individual securities and additional asset classes may be considered within the overall strategy.

Minimize Costs

Cost minimization is crucial in long-term wealth accumulation. Maximize the money used to compound over time for your wealth. Minimize money spent to enhance others’ wallets.

Costs include: fund commissions and loads; transaction costs on investment purchases and sales; annual expenses and management fees; accounting and bookkeeping; tax generation.

Understanding and controlling your investment costs is key to maximize portfolio growth.

review and rebalance

Portfolios should be periodically reviewed to ensure adherence to the target allocation, as well as to the cost and performance of individual investments.

The Investor Profile should also be reviewed periodically. As personal circumstances shift over time, so too must the Investor Profile and the resulting Target Asset Allocation.

After a review, it may be necessary to rebalance the actual portfolio to the target allocation. Specific investments or tactics may require adjustment.

In the event of a change in your personal situation, the Investor Profile and Target Asset Allocation may also need amending.