Why Use Lump Sum Investing?

In building your investment portfolio, you can utilize lump sum investing or dollar cost averaging (DCA).

For practical reasons, I think most investors should choose DCA. But there is a case for lump sum investing.

In this post, we will look at potential advantages of lump sum over DCA.

Assets Appreciate Over Time

Investors acquire assets they believe will appreciate in value over time. It makes sense then that the earlier one purchases an asset, the greater the long-term financial gain.

This is the main advantage of lump sum investing over DCA.

For example, your research has led you to conclude that Apple is an excellent long-term investment that will steadily climb in price. If you had $10,000 on hand and ready to allocate to Apple, it would be smart to invest it all immediately.

Believing Apple will steadily grow, you are buying shares today as cheap as they will ever be. Whereas, if you allocate your $10,000 over a longer period (1, 2, or 3 years) to invest, you will be paying a higher price with each purchase date.

But Do Assets Continually Appreciate?

The flaw in that logic is “steadily” grow. Asset values seldom, if ever, grow in a continuously rising straight line. Investments fluctuate in their performance. The more volatile, or risky, an asset, the greater the probable fluctuations in the short or medium term.

If you choose the wrong time to invest, you may experience some unrealized losses in the short term. And it may take an extended period to get back to positive territory.

But do core asset classes really appreciate over the long run?

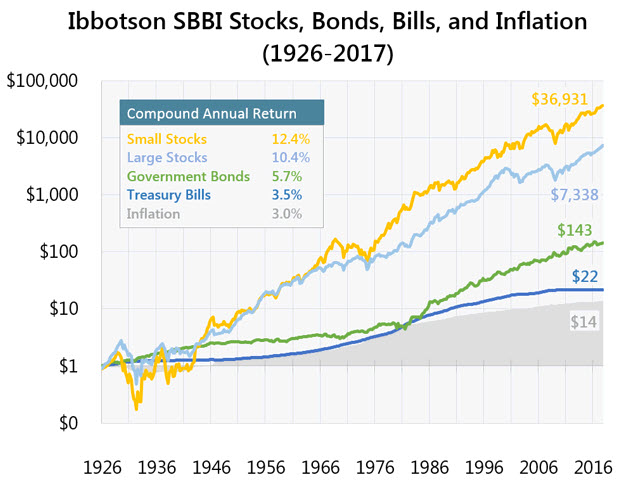

Past performance says yes. If we look at a graph from 1926 to 2017 for inflation, cash, fixed income, and equities, we see positive returns over extended periods. Of course, we also see substantial short term corrections as well.

As an aside, note how the risk-return relationship works in the real world. Cash, the safest asset class, provides the lowest nominal return. When you factor in the real return by subtracting inflation, there is not much growth. But your capital is secure. As you assume increasing risk with your investments, you see higher returns as you move up the risk ladder. And, as risk is a measure of asset volatility, you also can see that the higher risk assets are more price volatile in shorter terms.

Also note the impact over time of compound returns. The annual return over time between T-Bills and Bonds is 2.2%. And the difference between small and large cap stocks is 2.0%. Not that much. Probably what many investors pay their fund companies in management fees. Yet look at the cumulative growth differentials. Incredibly large over time. And why I harp constantly on cost minimization for investors.

Nice to see how the investment theory we have covered, actually plays out in the real world.

Whether this trend continues in the future is another question. But in the past, a lump sum approach would have been profitable over long periods. A better strategy than DCA.

Market Timing May Benefit Under Lump Sum

Or not.

If your market timing skills are excellent, then lump sum investing may be for you.

You would have loaded up your equity portfolio in the 1920s and then divested everything in 1929. Kept your cash under the mattress until 1932, then reinvested in equities. Or similar timing opportunities to sell and wait in January 1973, October 1987, and October 2008. By being very nimble, your growth through proper market timing would have been fantastic.

The problem, of course, is that market timing is extremely difficult. Even for the professionals.

However, if your market timing is wrong, lump sum may still be fine. You just require a lengthy enough time frame to recover. As you can see in the graph, had you bought US equities in 1929, they would have plummeted in the market crash. And yes, it may have taken to 1954 to get back to even. But the markets did recover and continue to grow over time. But you needed a substantial time horizon.

We will look at market volatility in more depth next post.

Less Fees in Lump Sum Investing

Another advantage of lump sum investing relates to transaction costs.

A lump sum investing approach should result in less transaction costs than under DCA.

Many online brokers now offer flat fee trades, regardless of shares bought or sold.

If you invest $10,000 in one lump sum, you may only pay a $10 commission. But if you divide that $10,000 into 10 separate transactions, you will end up paying $100 in total.

While not a lot, it is 1.0% of your initial capital. It should not be ignored, especially when you consider the compound annual return data from our graph above.

Okay, that is the case for lump sum investing.

It is cheaper and the lump sum approach typically outperforms DCA over the long run.

I like low cost. And I love outperformance.

So why do I think DCA is more appropriate for most investors?

We will get to that in “Why Use Dollar Cost Averaging?”