Why Use Dollar Cost Averaging?

Why should you build your investment portfolio over time using dollar cost averaging (DCA)?

Good question. Especially as we saw that lump sum investing may be preferable at times.

I tend to recommend DCA for a few reasons. Investment specific, but also for behavioural purposes.

Today, a look at the pure investing side arguments for DCA.

Market Volatility

In my previous post (linked above), over a long time horizon, lump sum usually outperforms. That is because the core asset classes grow in value over time. It makes sense to buy as early as possible.

However, that asset growth is seldom steady.

Dealing with short to medium term market volatility is an advantage of DCA.

At least in theory. In actuality, a case can still be made for lump sum investing. It all revolves around how the longer the time horizon, the more one can withstand asset volatility.

Perhaps you invested 100% of your funds in the U.S. stock markets in the summer of 1929. Between 1929’s peak and the 1932 bottom, the Dow Jones Industrial Average (DJIA) fell 89%. Yet over the long run, you still would have turned a profit with lump sump investing. Even if you had bought at the high point in 1929.

Of course, it would have taken until 1954 to get back to your initial break-even point. But once there, it was smooth long-term growth for a while. Assuming that you were still alive 30 years after the crash, you would have seen positive growth.

Or what if you invested 100% of your assets in early October 1987? On October 19, the DJIA fell 22% in a single day. It took until late 1989 to fully recover.

Or in early October 2008? On October 1, the DJIA traded as high as 11,022. By October 10, it had reached a low of 7774 before closing the day at 8451. A 29.5% drop from high to low in just 10 days. Had you bought just prior to the crash, with a brief exception in April 2010, you would have only returned to your initial investment level at the end of 2010.

Considering the Dow traded around 26,600 as at April 30, 2019, you would have done just fine regardless when you invested. Obviously, not as well as if you timed it better. And likely not as well as having invested in lower risk, less volatile, asset classes. But you would have still shown a positive return over time.

However, you might be in for a lengthy wait to achieve those returns. And depending on the periods involved, you may have achieved superior overall performance through DCA.

DCA May Provide Protection for Shorter Time Horizons

While core asset classes have provided net positive returns over time, there clearly have been hiccups along the way.

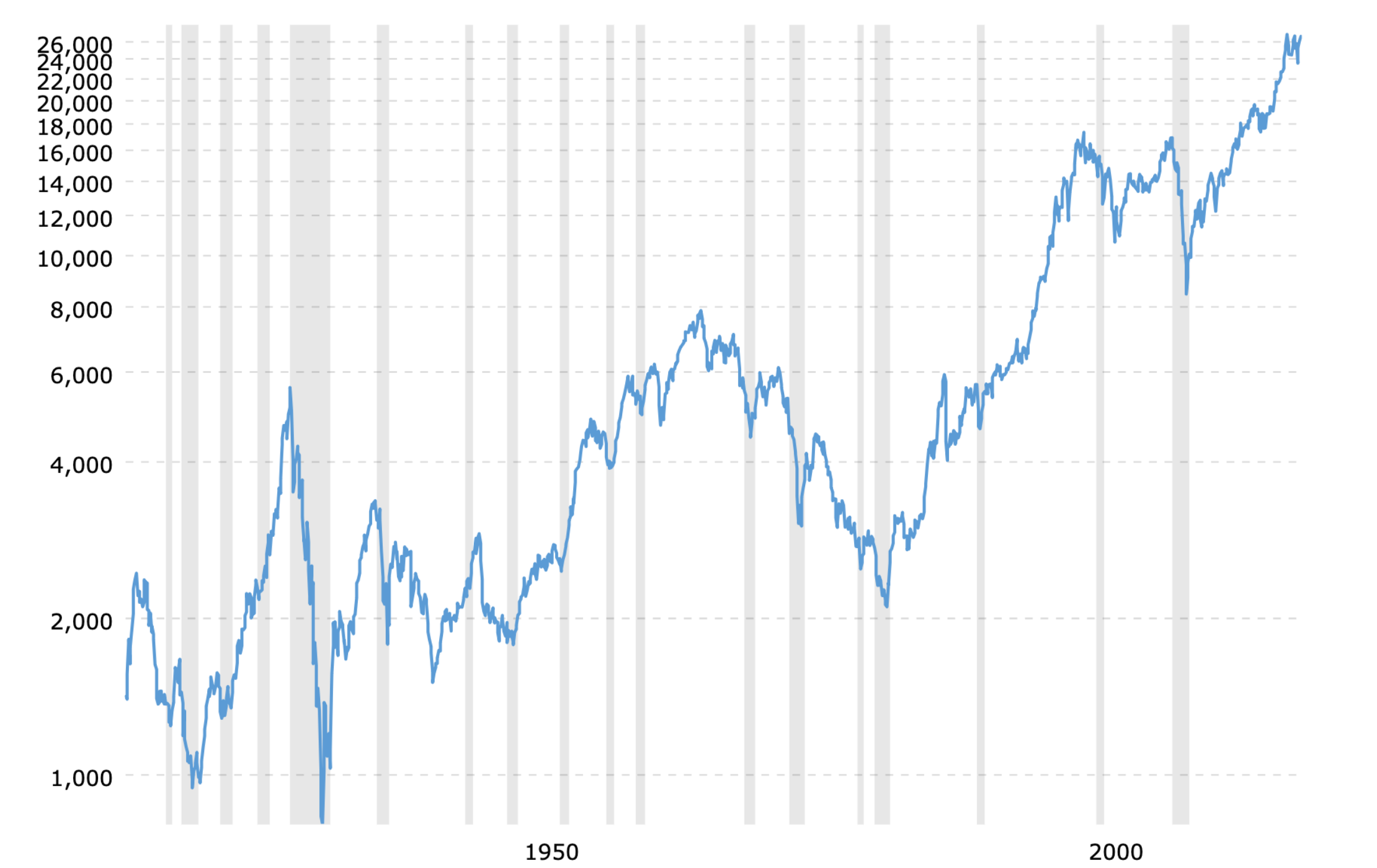

This chart from April 1915 to April 2019, courtesy of Macrotrends, provides a nice picture of the DJIA general growth and price fluctuations over time.

As you can see, over the long haul US equities have increased in value. But do you have a 100 year time horizon? Some of the corrections required between 16 and 25 years to recover. If you are fully invested and get caught in a major bear market, that will hurt.

For example, in January 1966 the DJIA traded at 7862. It fell until May 1982, then began to grow again. It was not until October 1995 that the DJIA closed at 7865 and returned to its trading level from 1966. Almost 30 years with zero growth.

To smooth out short and medium term volatility, DCA provides some protection. You can see the potential impact of investing in equal dollar amounts on a monthly, quarterly, or annual basis. When markets are high, you purchase relatively fewer shares. When there is a correction, you purchase relatively more, as you are buying at a “discount.”

And, as we will see much later, through periodic reviews and rebalancing, you may be able to lock in some gains before a crash occurs. That also helps to protect your portfolio from severe market volatility in shorter time periods.

DCA is the Best Approach?

For shorter investment time frames, DCA may allow for outperformance over a lump sum approach. But so much of whether it will outperform depends on the actual time periods involved.

Had you begun a quarterly DCA investing approach in January, 1966, you would have experienced declining equity markets until mid 1982. A significant period of time. You would have been wiser to invest in fixed income or cash from 1966 until 1982, then purchase 100% of your equities at that time. Of course, how many experts predicted the peaks and valleys for you to correctly time the markets?

But by buying continuously as the market declined, you bought at a discount over time. Then when the market began to rise in late 1982, your average cost base was much better than if you had made a lump sum purchase anytime between 1966 and 1976.

In short, over the extreme long run, lump sum may be better. But investors seldom have very long time periods. DCA offers protection against getting caught in a major correction. Usually a safer and smarter way to invest for most people.

On a pure investing basis, DCA may or may not be better than lump sum. Given that most investors do not have infinite time frames, DCA tends to be a preferable method.

Where I do think DCA definitely shines, is in promoting good investing habits for individuals.